Furnish to agent dealer and distributor before 31st March on the following year. Following the Malaysian Governments implementation of the Movement Control Order from March 18 2020 to March 31 2020 to control the spread of COVID-19 the Malaysian Inland Revenue Board MIRB announced on March 17 2020 that tax return filing and balance of tax payment deadlines falling between March 2020 until June 2020 have been.

Malaysia Personal Income Tax Guide 2021 Ya 2020

By 30 April in the year following that YA Tax returns are not required to be filed for specific groups of employees where requirements are met.

. You from being charged tax increase court action and. According to the BE form resident people who do not engage in business the deadline for reporting income tax in Malaysia for manual filing in 2020 is 30 April 2021 and for e-filing in 2020 is 15 May 2020. Personal Income Tax Deadline Reminder.

52019 of 16 October which explains the penalties imposed on taxpayers that fail to file returns by the prescribed deadlines under the Income Tax Act 1967 the Petroleum Income Tax Act 1967 and the Real Property Gains Tax Act 1976. The Government has announced an extension of two months for filing income tax from the original. Monthly Tax Deduction will be final tax.

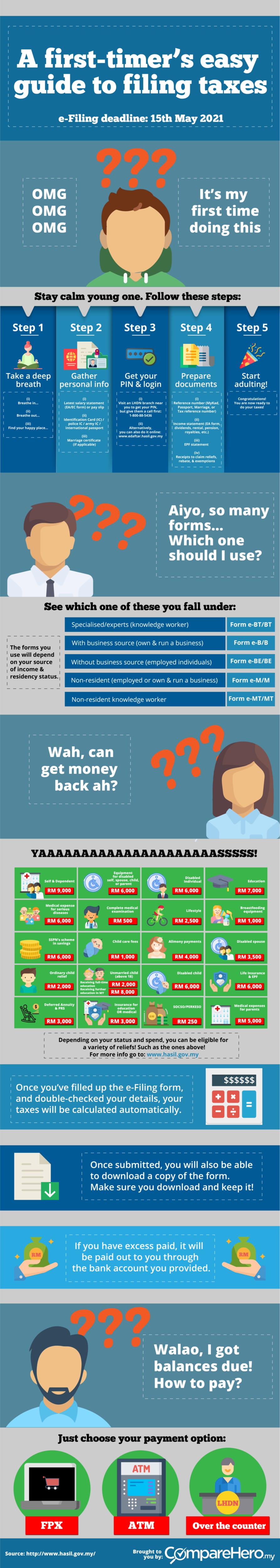

As such taxpayers are required to submit their income tax returns to Inland Revenue Board of Malaysia LHDN within the prescribed time frame by LHDN usually by 30 April in the year following the tax assessment for individuals without business income or by 30 June in the year following the tax assessment for individuals with business income. Malaysia extends income tax filing deadline March 29 2020 April 5 2020 COVID-19 Filing deadlines Filing return Submission of returns Asia-Pacific Malaysia. However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia.

The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. Furnish to LHDN - Only need to submit upon request by IRB. The Inland Revenue Board of Malaysia IRBM has published Operational Guideline No.

Income from RM3500001. The deadline for submitting Form BE for the Year of Assessment 2019 is April 30 2020. Also stoppage from leaving Malaysia.

The Guidelines includes that the penalty. You might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively. Form C Income tax return for companies Deadline.

Malaysia Various Tax Deadlines Extended Due. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022. Income from RM5000001.

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. Also the MIRB has closed all its office premises until 14 April 2020 but is providing some. Original deadline Revised deadline e-Form BE e-Form M Personal Tax Return with no business income ie employment income andor investment income and balance of tax payment 15 May 2020 30 June 2020 e-Form B e-Form M Personal Tax Return with business income and balance of tax payment 15 July 2020 31 August 2020.

LHDN urged taxpayers to submit their forms and pay their income tax within the stipulated. Business income B Form on or before 30 th June. Income from RM500001.

In the table below the fines are stated as follows. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Pay taxes after 30th June.

Malaysia Residents Income Tax Tables in 2019. Date of online submission may subject to change. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Income tax return for individual with business income income other than employment income Deadline. For further information kindly refer the Return Form RF Program on the. Business income e-B on or before 15 th July.

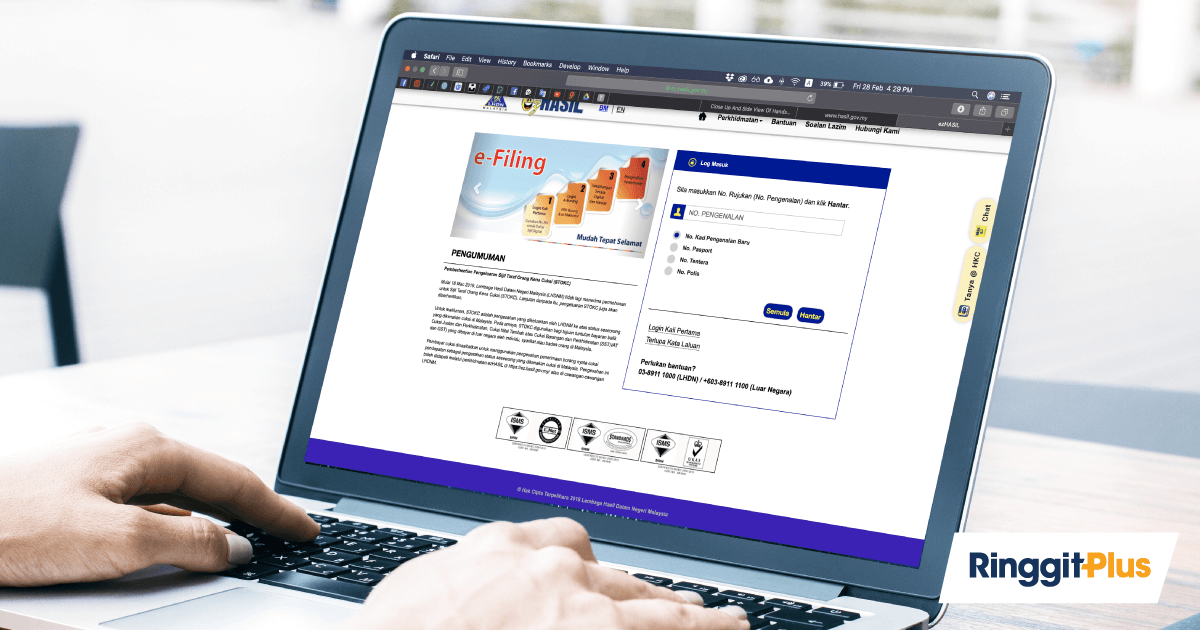

We would like to remind all taxpayers including sole proprietors and partners to file their income tax returns. Individuals with business income Submission of income tax return - Resident - Non-resident. CYBERJAYA Feb 28 Taxpayers can submit their income tax return forms for 2019 via the e-Filing system starting March 1 the Inland Revenue Board of Malaysia LHDN said in a statement today.

Form P Income tax return for partnership Deadline. For the e-Filing of Form BE Form e-BE for the. The applicable forms are E BE B P BT M MT TF and TP.

The tax filing deadline for person by 30 April in the following year. Aside from having to pay more if youre late to submit your tax form you will get fined if you understated your taxes dont submit a form at all or for various other offences. Employment income e-BE on or before 15 th May.

30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Submission of income tax return - Resident - Non-resident. Paying income tax due accordingly may avoiding.

Form PT Income tax return for LLP. Employment income BE Form on or before 30 th April. Income from RM2000001.

30062022 15072022 for e-filing 6. 7 months after financial year end 8 months for e-filing 8. However if LHDN request for listing of CP58 information a taxpayer company is required to submit all information including amounts below RM500000.

How To File For Income Tax Online Auto Calculate For You

Pin On Tds Return Filing Software

Income Tax Malaysia 2019 Deadline

Tax Return 2019 A Stress Free Guide To Tackling It Self Assessment Tax The Guardian

Yk Group Latest Update From Lhdn On Income Tax Filing Facebook

Income Tax Malaysia 2019 Deadline

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To File For Income Tax Online Auto Calculate For You

How To File For Income Tax Online Auto Calculate For You

Know Penalty For Filing Returns After 31 August 2019 And Repercussions

How To File For Income Tax Online Auto Calculate For You

Notice Regarding Extension Of Filing Deadline For Labuan Corporate Tax Lbata 1990 And Personal Income Tax Bona Trust Corporation 博纳信托有限公司

Yk Group Latest Update From Lhdn On Income Tax Filing Facebook

Know Penalty For Filing Returns After 31 August 2019 And Repercussions

Irb Extends Income Tax Filing Deadline By Two Months The Edge Markets

Malaysia Payroll What Is Pcb Mtd

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief